financial planning services that start with Clarity

Built on a firm foundation, our financial services always start with clarity—helping you get on track toward your goals and leaving a more purposeful legacy.

It’s Difficult to Plan Ahead When You Don’t Have a Clear Path Forward

As your wealth grows over time, so does its complexity. You may have multiple 401(k)s, forgotten insurance policies, or a scattered estate plan. While you have a lot of assets, you might still wonder what your wealth will look like in five, ten, or twenty years.

That’s why at Legacy Planning Advisors, we start with clarity. We’ll look into each piece of your wealth picture, including investments, savings, tax liabilities, and more, and use it to create a strategy that provides you with a clearer view of the future. From there, we’ll support you in whatever comes next, as you plan for retirement, sell your business, or build your legacy.

Our Financial Planning Services

All of our services start with a comprehensive financial plan uniquely tailored to your goals. Then, we assess what services will benefit you most and integrate them into your plan.

Financial

Planning

Our financial planning service is a multi-step deep-dive into your current financial situation and where you want to go from here. Our team will rigorously analyze your cashflow, investments, assets, and more, and from there create a clear plan that opens up more opportunities for you and your family.

Investment Management

Your investment portfolio is a significant part of your financial plan, especially when you get closer to retirement. Legacy Planning Advisors has extensive access to a number of investments, from private to public, and can craft a strategy that makes sense for both your biggest goals and your deepest values.

Business Transition Planning

You’ve worked hard to grow your business over time, so when you step away, you want to know it will stay in good hands. Our team can help you create a long-term business transition plan, whether you plan to sell or for a family member to succeed you. We’ll be by your side as you navigate business valuation, structuring the sale, and eventually stepping away.

Estate and Legacy Planning

Establishing a legacy is a vital part of any plan. We take great care to understand what matters most to you—your values, your family, and the impact you want to make—in order to help you craft a robust estate strategy. And when plans change, our team will be right there to address your needs.

Philanthropic

Planning

A solid financial plan opens up potential opportunities to show generosity, both to your family and to causes you care about. Together, we can explore more effective ways to leave a legacy—including education savings accounts, charitable trusts, giving from your estate, and even easing your tax burden through charitable giving.

Tax

Planning

Your tax liability plays into every aspect of your financial plan, whether you are planning to sell your business, are setting goals for retirement, or are making key decisions about your estate. Our team will work to create a strategy that potentially minimizes your tax burden.

Your Financial Plan Starts Here

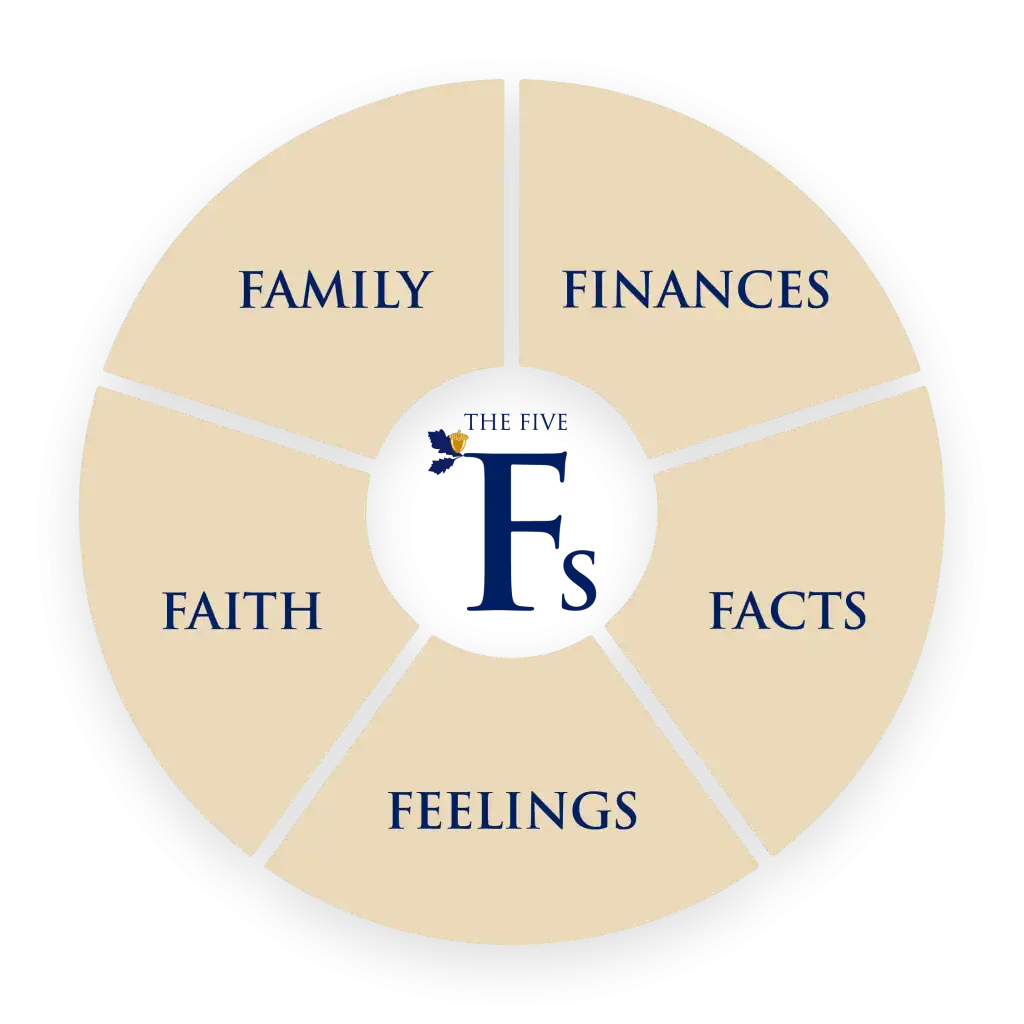

When we create your financial plan, we don’t just look at the numbers. In fact, the numbers are only one small piece of the puzzle. At Legacy Planning Advisors, we use a tool called the Five Fs to take a deep-dive into your life situation and create a strategy around them. Because your entire life matters, not just your money. And understanding more about you can help us create a more meaningful next chapter for your life.

Finances

Facts, feelings,

family and faith all

influence our

approach to

and decisions

about finances.

Facts

The facts of your life,

your unique abilities,

and personality, will

influence what

and

how you think

and do.

Feelings

Emotional

complexities

around life events

and people

influence our

decisions.

Faith

What you believe

influences what

you do.

Family

Depending on your

family, you can

experience joy,

unresolved conflict,

peace or discontent.

Hover over numbers to learn more

Tap numbers to learn more

Your Financial Plan Starts Here

When we create your financial plan, we don’t just look at the numbers. In fact, the numbers are only one small piece of the puzzle. At Legacy Planning Advisors, we use a tool called the Five Fs to take a deep-dive into your life situation and create a strategy around them. Because your entire life matters, not just your money. And understanding more about you can help us create a more meaningful next chapter for your life.

Join Us for A Free Consultation

When we first meet with you, you can expect a laid-back conversation in a relaxed environment. We simply want to get to know you and understand what your financial needs and goals might be. From there, we’ll start deep-diving into how we can best serve you, but we start with clarity.

Our consultations are no-obligation—you won’t find any sales pitches or pricing sheets. Come join us in our Suwanee office or over a video call and let’s get started!

FAQ

Yes, Legacy Planning Advisors is a fiduciary, meaning we are held to a very high standard as advisors.

All of our investment advice and financial planning is in your best interest—we won’t try to sell you products

or services you don’t need.

At Legacy Planning Advisors, we understand that deciding to work with a financial advisor is an important decision. While we would be honored to have the opportunity to serve you, our main priority is ensuring you find the right fit for your specific needs and circumstances.

We tend to provide the greatest value for clients with at least $1 million in investable assets who are facing pivotal life transitions or have multifaceted planning needs. Whether you are a business owner, corporate executive, widow, or anyone else, we welcome the chance to explore how we may be able to support you.

No, you do not have to live in Suwanee to work with us, but it does make in-person meetings easier. Our team

is also available for phone or video meetings if need be.

We have access to a robust variety of investments from private to public. We approach investment

management from a values-based perspective. We want to honor our clients’ values and beliefs in their

investment strategy, so we look carefully at each investment to ensure the venture is not causing harm or

offering products or services that go against ours and our clients’ values.