Personalized Financial Planning for a Purposeful Legacy

Your financial plan is about more than how much you will save or spend. It’s a plan that drives you toward your goals and remains committed to your deepest-held values.

financial planning services in greater atlanta, ga

Whether you are heading for retirement, want to sell your business, or simply want a clearer plan for the future, we’re here to help. A solid financial plan starts with clarity, and we are here to help provide that for you. Wherever life has taken you so far, let’s chart a course for a future with greater impact and more peace of mind. We divide our financial planning process into five different sections so we have a comprehensive view of where you’ve been and where you want to go.

Helping and Protecting Family

• Helping Children

• Assisting Parents

• Funding Education

• Retirement Transition Planning

Enjoying and Protecting Lifestyle

• Income Needs

• Leisure Planning

• Personal Health

• Protecting Assets and Business

Planning Ahead

• Clarifying Vision

• Health Challenges

• Managing Change

• Life Transition Planning

Creating Financial Comfort

• Managing Resources

• Generating Income

• Minimizing Taxes

• Working with an Advisory Team

Building a Legacy

• Wills and Power of Attorney

• Wealth Transfer

• Charitable Giving

• Living Legacy

Meet The Sheltons

Charles and Lindy Shelton, ages 56 and 54, were referred to us by their CPA over 20 years ago. The couple had three grown children, but the relationship with the children was not strong. When they came to us, both were employed and the husband had been with a well-known US corporation for 15 years. They had been faithful to pay down debt, tithe to their local church, and contribute to their retirement accounts. They initially approached us about helping them stay on track for retirement and working through estate issues; however, at a later point they required substantial help to correct an investment mistake they made against our counsel.

How Do You Define “Quality of Life” for Yourself?

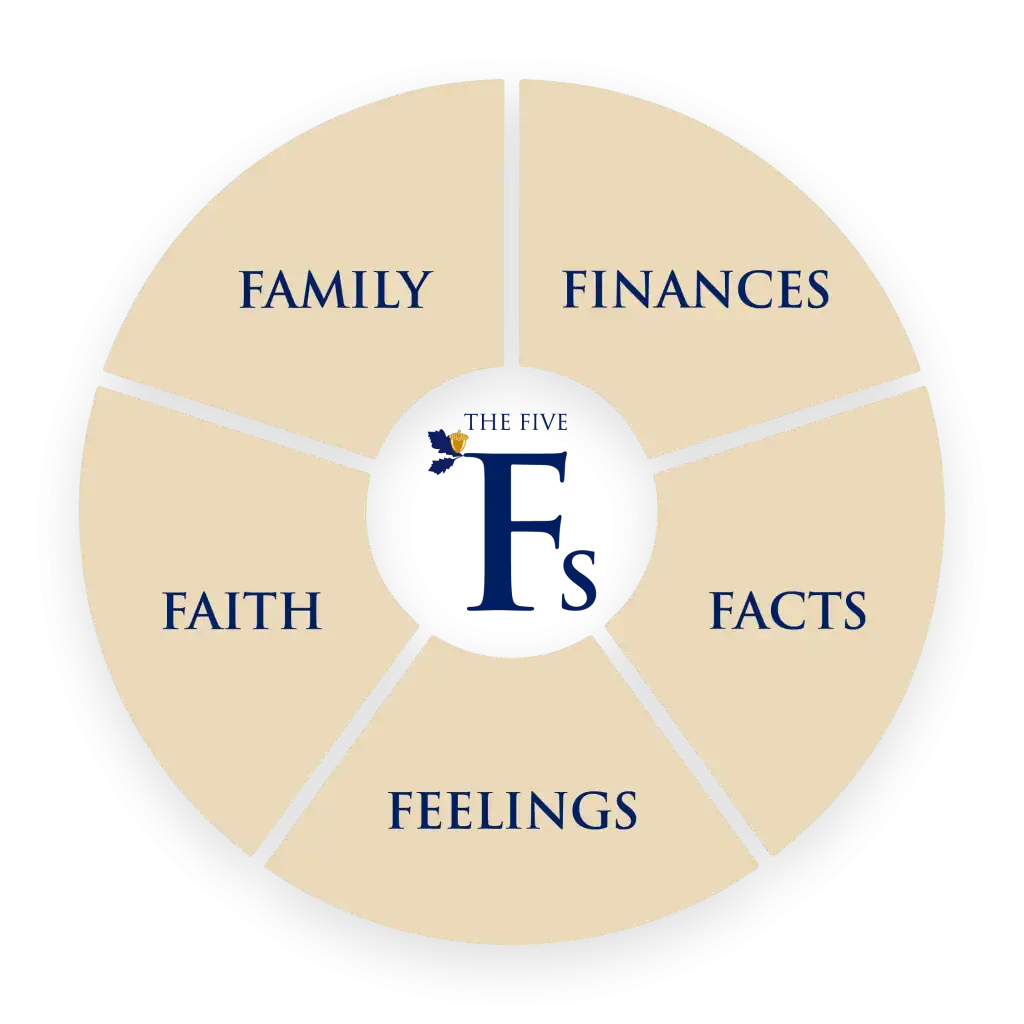

Having a good “quality of life” is about more than having enough money. It’s about having meaningful relationships with your friends and family. Having hobbies that bring you joy and fulfillment, health that allows you to stay active. And it’s about staying true to your deepest-held values and beliefs through it all. At Legacy Planning Advisors, we’ve narrowed down these aspects of your life into the five Fs:

- Family: Your relationships with your family members and the ones you love.

- Finances: The wealth that you have, and how you approach it.

- Facts: The things that are intrinsically true about you, like your personality and abilities.

- Feelings: Emotional responses you have around life events and the people who surround you.

- Faith: Your deepest held beliefs and values.

Your wealth is intrinsically woven into each aspect of your quality of life.

Finances

Facts, feelings,

family and faith all

influence our

approach to

and decisions

about finances.

Facts

The facts of your life,

your unique abilities,

and personality, will

influence what

and

how you think

and do.

Feelings

Emotional

complexities

around life events

and people

influence our

decisions.

Faith

What you believe

influences what

you do.

Family

Depending on your

family, you can

experience joy,

unresolved conflict,

peace or discontent.

Hover over numbers to learn more

Tap numbers to learn more

Clarity is Within Reach

It all starts with a conversation with our team where we will talk about your financial goals, what you value most, and how we can work together. From there, we’ll create a financial plan that reflects our conversation with you. This conversation is completely fee- and obligation-free.

FAQ

During major life transitions like retirement, a job change, selling a business, or the loss of a spouse, it may be time to partner with a financial planner. We can also help individuals and families simplify complex financial situations, like running a successful business or managing a family estate.

Our comprehensive financial planning includes a full evaluation of your financial life: cash flow analysis, retirement planning, investment recommendations, insurance reviews, tax strategies, estate planning, and charitable giving. In our planning process, your goals and values are at the forefront of our strategy, ensuring your financial plan is uniquely tailored to you.