A Meaningful Legacy,

A Purposeful Approach

Our financial planning approach takes more than your money into account. It explores the many aspects of your family, values, and life to create a more comprehensive picture.

Our Purposeful Planning™ Approach

Wise Counsel

We provide the wise counsel of an advisor: answering your financial questions, offering guidance as we craft your plan, and making adjustments to your strategy as we go.

Lasting Relationships

We offer the lasting relationship of a counselor: walking alongside you as life changes, the markets fluctuate, and your goals evolve.

Continuity

We promise the continuity of a leader: even when the markets shift or your future becomes more uncertain, we’ll remain constant, offering practical, objective advice at every step of the way.

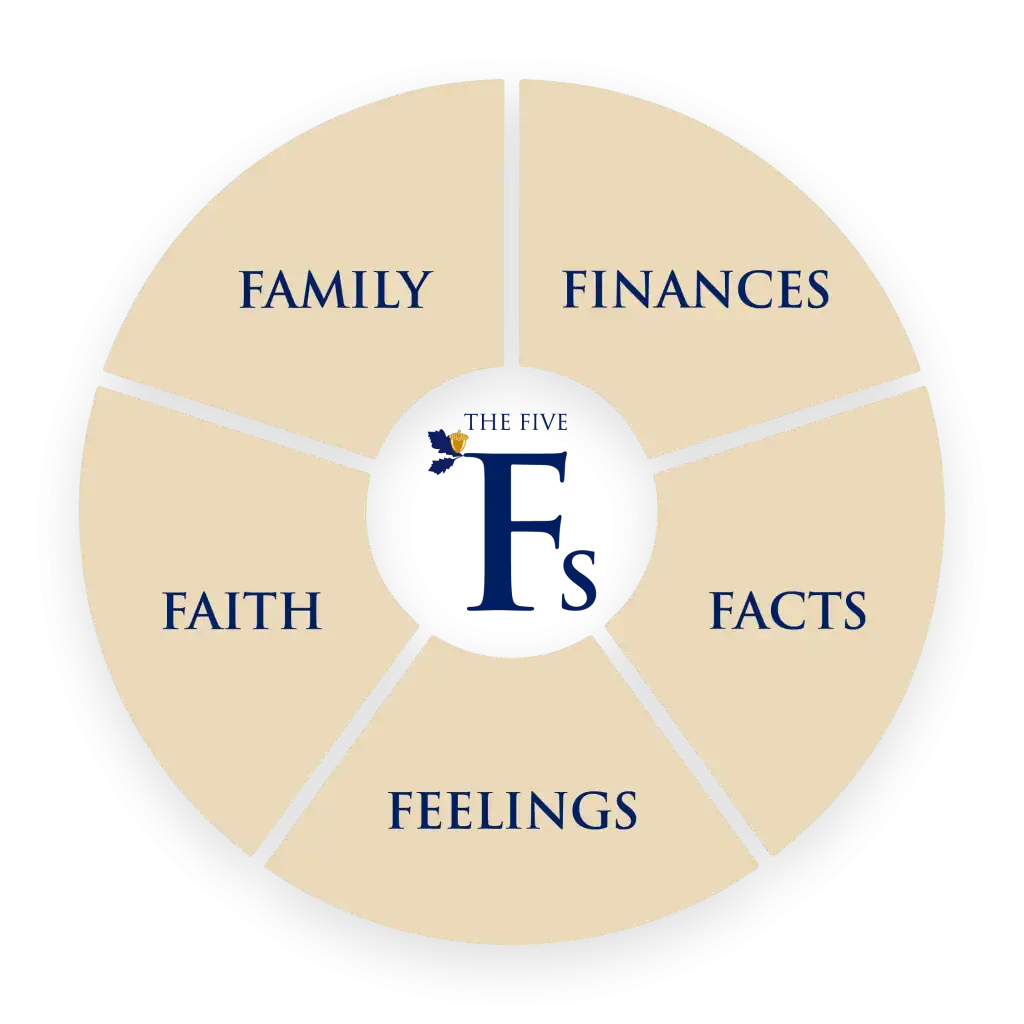

Finances

Facts, feelings,

family and faith all

influence our

approach to

and decisions

about finances.

Facts

The facts of your life,

your unique abilities,

and personality, will

influence what

and

how you think

and do.

Feelings

Emotional

complexities

around life events

and people

influence our

decisions.

Faith

What you believe

influences what

you do.

Family

Depending on your

family, you can

experience joy,

unresolved conflict,

peace or discontent.

Hover over numbers to learn more

Tap numbers to learn more

Your Financial Plan Starts Here

When we create your financial plan, we don’t just look at the numbers. In fact, the numbers are only one small piece of the puzzle. At Legacy Planning Advisors, we use a tool called the Five Fs to take a deep-dive into your life situation and create a strategy around them. Because your entire life matters, not just your money. And understanding more about you can help us create a more meaningful next chapter for your life.

Take Our Assessment

Are you curious to see how you currently define your quality of life? Using our 5 Fs model, we’ve created an assessment that can help you gauge your current satisfaction with your life and where you want to go in the future.

Put Our Process to Work for You

It all starts with a conversation with our team where we will get to know you and your financial goals. From there, we’ll create a financial plan that reflects our conversation with you. This conversation is completely fee- and obligation-free. Our consultations are no-obligation—you won’t find any sales pitches or pricing sheets. Come join us in our Suwanee office or over a video call and let’s get started!

FAQ

Our planning process consists of 4 meetings scheduled roughly 3 weeks apart depending on your stage of life and current financial picture. We can move at whatever pace with which you are comfortable.

Our first meeting is a laid-back conversation where we simply get to know you and your financial needs. Come with any questions you may have about your money or our process. Feel free to bring your loved ones with you as well—your spouse, children, or even business partners. We will work with you in advance of the meeting to obtain copies of documents such as tax returns and investment statements that will facilitate a productive conversation. From there, our team will start strategizing a plan that we’ll propose to you a few weeks after our initial meeting.

No, you do not need to be a Christian to work with us. As a team, we value our Christian faith and are guided by Scripture, but we honor and respect the various religions and creeds that our clients are guided by as well. If we are a good fit relationally and can help you with your financial needs, we are happy and honored to work with you.