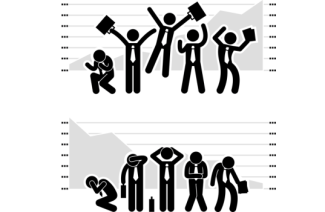

Behavior Bias By Peter Geckeler

I remember being told as a student in the Financial Planning program at the University of Georgia (Go Dawgs!) that a majority of my role in the profession would be behavior modification. That statement struck me, because I thought financial planning was about investment due diligence, cash flow management, other fancy financial words – but I quickly found out that my professor was correct.

We all have certain behavioral biases hardwired into us, and then biases we pick up overtime through experience. There is actually a whole study on financial behavioral bias, and multiple lists online of the most notable. Here’s an example of a hardwired bias – Susie is, and has always been, a conservative, shy individual who does not like danger or taking chances. Susie’s hardwiring makes her less inclined to take risk because of the anticipated regret of a loss when she invests, and may cause reluctance on Susie’s part to sell losing investments to avoid confronting the fact that she made a poor long-term investment decision. Susie is prone to the financial bias of “Regret Aversion.” On the other hand, Jacob has worked in real-estate his whole life, and because of that experience states that he will only invest in hard assets such as commercial real-estate. Jacob suffers from “Familiarity Bias,” which occurs when an investor has a preference for familiar or well-known investments despite the seemingly obvious gains from diversification. This can ultimately lead to Jacob only ever owning a suboptimal portfolio with a greater a risk of losses.

At Legacy Planning Group, we have a tool called Financial DNA and a set of refined questions that allows us to look into an individual’s hardwiring and life circumstance to diagnose what behavioral biases you may be inclined to experience. Give us a call if you want to find out more!

http://www.investopedia.com/advisor-network/articles/051916/8-common-bia...